The stay-at-home order issued in March in response to COVID-19 has forced thousands of businesses to shut down overnight—putting millions of Americans out of work and scrambling for ways to make ends meet.

On March 18, President Trump signed into law the Families First Coronavirus Response Act (FFCRA), which allowed flexibility for state unemployment agencies and additional administrative funding in response to the COVID-19 pandemic. The Coronavirus Aid, Relief, and Economic Security (CARES) Act was then signed into law on March 27.

It expands states’ ability to provide unemployment insurance for those impacted by the pandemic, including for workers who are not ordinarily eligible for unemployment benefits.

“The CARES Act provides valuable relief to American workers facing unemployment, including unemployed workers who may not otherwise be eligible for regular Unemployment Insurance benefits,” U.S. Secretary of Labor Eugene Scalia said. “Including $500 million in emergency administrative funding.”

As part of the initial $2 trillion coronavirus relief package, $268 billion was allocated towards unemployment benefits, allowing for those qualified to receive an additional $600 per week as well as extending the benefits for as much as 13 weeks.

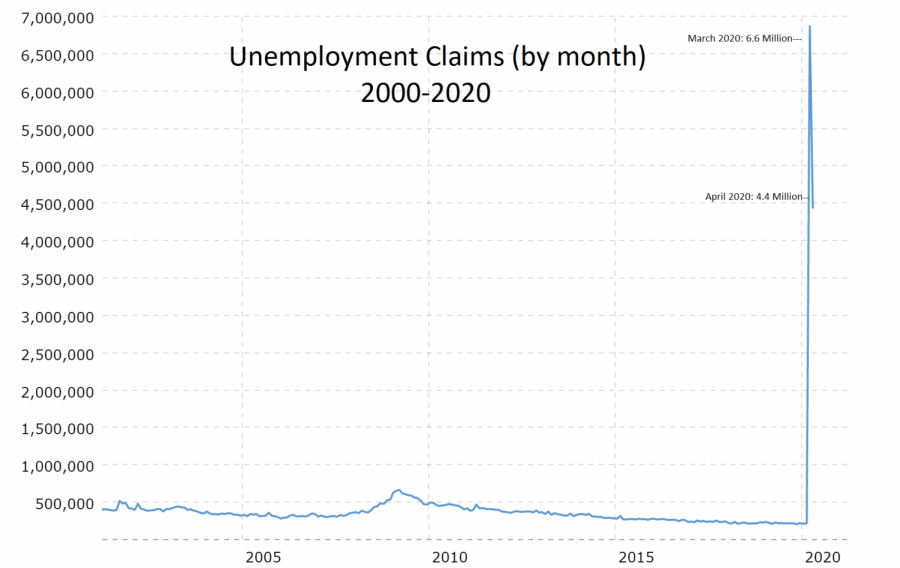

The U.S. has seen a record 26.5 million initial claims since March 14, showing that this may very well be the lifeboat that will keep many Americans from drowning during a time where the unemployment rate is projected to reach 13%, the country’s worst since both the 2008 recession and the Great Depression.

With the new regulations in place, many who may have not been eligible can now be certified to receive benefits, and in the application, there is an additional option under “reasons for unemployment” that allows for those out of work due to the coronavirus.

This has opened up the benefits for student workers, part-time workers, retail, restaurant and hospitality employees to all be qualified to receive bi-weekly payments, which are deposited through a Bank of America Visa debit card provided by the Department of Labor.

All claims and benefits are processed through the state’s Employment Development Department’s website, and there is no need to call or go into your city’s unemployment office to receive benefits.

The process is straightforward and takes about an hour, and requires applicants to provide information on where they have been working and their tax information.

After the application is reviewed and approved, which takes 1-2 weeks, there will be confirmation sent by mail providing an account number and an online certification; as soon as the certification is complete, your first two-week payment will be issued and your debit card will be received within 5-7 business days.

All told, the entire process from application to receiving money can take 2-3 weeks.

After the initial claim, there are weekly check-ins to ensure that you are still seeking employment and able to work. You can certify for benefits every two weeks.

The payment consists of a percentage of what you would be making at your last employer, based on quarterly pay, plus the additional $600 emergency relief every week.

Though the benefits are only available for a couple of months, they can be the difference between losing a residence or going without food and being able to provide until the pandemic eases its grip on everyday life.

For more information, visit the California unemployment benefits website.